The Ultimate Profession Course for Independent Insurance Adjusters in the Insurance Policy Field

Browsing the detailed web of chances within the insurance coverage sector can be a complicated yet satisfying trip for independent insurers seeking to carve out an effective career path. With the market continuously advancing and providing brand-new difficulties, it comes to be vital for insurance adjusters to not only understand the fundamentals however also to adapt, specialize, and excel in their duties. From honing important abilities to going after innovative accreditations, the utmost occupation trajectory for independent adjusters is a multifaceted surface that demands strategic planning and continuous growth. As experts in this dynamic area stand at the crossroads of countless opportunities, the crucial lies in opening the door to a realm where specialization, network, and knowledge converge to create a roadmap for unequaled success.

Comprehending the Insurance Market Landscape

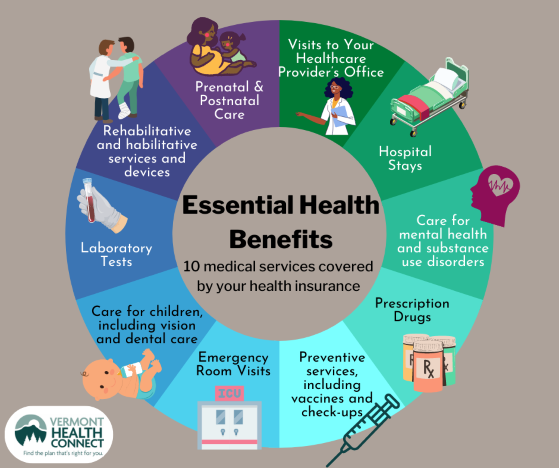

Comprehending the insurance coverage industry landscape is essential for independent adjusters to browse the complexities of this industry successfully and effectively. The insurance coverage market is a substantial and dynamic field that incorporates various kinds of insurance coverage, consisting of home, life, casualty, and wellness insurance policy - independent adjuster firms. Independent insurers should have a comprehensive understanding of the various sorts of insurance plan, protection limits, policies, and market trends to excel in their functions. By staying informed regarding market growths, such as emerging technologies, governing modifications, and market needs, independent insurance adjusters can better offer their customers and make notified decisions throughout the insurance claims modification procedure.

Additionally, a deep understanding of the insurance policy sector landscape makes it possible for independent insurance adjusters to construct strong connections with insurer, insurance policy holders, and various other stakeholders. By having a solid understanding of exactly how the sector operates, independent insurers can successfully work out settlements, solve disagreements, and supporter for reasonable case results. Generally, a comprehensive understanding of the insurance coverage market landscape is a fundamental aspect for success in the field of independent adjusting.

Creating Necessary Abilities and Expertise

Moreover, a strong grasp of insurance regulations and policies is necessary. Insurance adjusters need to stay updated with market requirements, guidelines, and legislations to ensure compliance and supply precise recommendations to customers - independent adjuster firms. Furthermore, analytical abilities are vital for independent adjusters who typically experience difficult circumstances that call for quick reasoning and ingenious options to satisfy customer needs

Constant learning and expert advancement are key to remaining affordable in this field. By developing these vital skills and know-how, independent adjusters can construct successful careers in the insurance coverage industry.

Structure a Strong Professional Network

Developing durable links within the insurance coverage sector is essential for independent insurance adjusters seeking to advance their careers and expand their opportunities. A solid expert network can offer beneficial assistance, insights, and partnership opportunities that can boost an insurer's skills and track record within the industry. Structure connections with insurance carriers, claims supervisors, fellow adjusters, and other industry experts can open doors to new assignments, mentorship opportunities, and possible references. Going to market meetings, networking events, and engaging with colleagues on expert systems like LinkedIn can aid independent insurance adjusters increase their network and remain updated on industry fads and best practices.

In addition, networking can likewise result in partnerships and partnerships with various check out here other experts in associated areas such as insurance coverage representatives, contractors, and attorneys, which can even more improve an adjuster's capability to offer effective and extensive insurance claims services. By actively purchasing structure and preserving a solid expert network, independent insurance adjusters can place themselves for lasting success and development in the insurance policy industry.

Progressing to Specialized Insurance Adjuster Duties

Transitioning to specialized insurer duties requires a deep understanding of specific niche areas within the insurance market and a dedication to continuous discovering and expert growth. Specialized adjuster functions offer opportunities to focus on specific kinds of cases, such as home damage, bodily injury, or workers' compensation (independent adjuster firms). These roles require a greater degree of proficiency and frequently call for added qualifications or specialized training

To progress to specialized insurance adjuster positions, individuals ought to think about pursuing industry-specific accreditations like the Chartered Property Casualty Expert (CPCU) or the Partner in Claims (AIC) designation. These certifications show a commitment to grasping the ins and outs of a specific location within the insurance policy area.

In addition, acquiring experience in expanding and taking care of intricate insurance claims expertise of pertinent laws and regulations can improve the possibilities of transitioning to specialized roles. Constructing a strong specialist network and looking for mentorship from skilled adjusters in the preferred niche can additionally give valuable insights and open doors to innovation opportunities in specialized insurer positions. By continuously developing their skills and staying abreast of market fads, independent insurers can place themselves for an effective profession in specialized roles within the insurance policy field.

Achieving Specialist Certifications and Accreditations

Making expert accreditations and accreditations in the insurance policy field signifies a commitment to specialized experience and recurring specialist advancement beyond conventional adjuster functions. These qualifications confirm an adjuster's understanding and skills, setting them apart in a competitive market. Among the most acknowledged accreditations for adjusters is the Partner in Claims (AIC) designation, used by The Institutes, which covers essential claim-handling concepts, policy analysis, and lawful factors to consider. One more prestigious accreditation is the Chartered Home Casualty Expert (CPCU) designation, demonstrating a deep understanding of insurance coverage items and procedures.

Verdict

Finally, independent insurance adjusters in the insurance policy market can achieve career success by comprehending the sector landscape, establishing important skills, constructing a strong specialist network, advancing to specialized functions, and obtaining expert accreditations. By following these steps, insurers can boost their experience and trustworthiness in the field, inevitably resulting in raised opportunities for innovation and success in their occupations.

Furthermore, a deep understanding of the insurance sector landscape allows independent insurers to construct strong partnerships with insurance policy companies, policyholders, and other stakeholders. Building a strong professional network and seeking mentorship from experienced insurers in the preferred particular niche can additionally give useful understandings and open doors to development opportunities in specialized insurance adjuster settings. By continuously refining their skills and remaining abreast of market trends, independent adjusters can place themselves for an effective profession in specialized duties within the insurance coverage field.

Additionally, insurers can seek qualifications details to their area of passion, such as the Certified Catastrophe Risk Administration Professional (CCRMP) for disaster insurance adjusters or the Certified Automobile Evaluator (CAA) for vehicle insurance claims professionals. By acquiring specialist certifications her response and accreditations, independent adjusters can increase their job chances and demonstrate their commitment to quality in the insurance coverage sector.